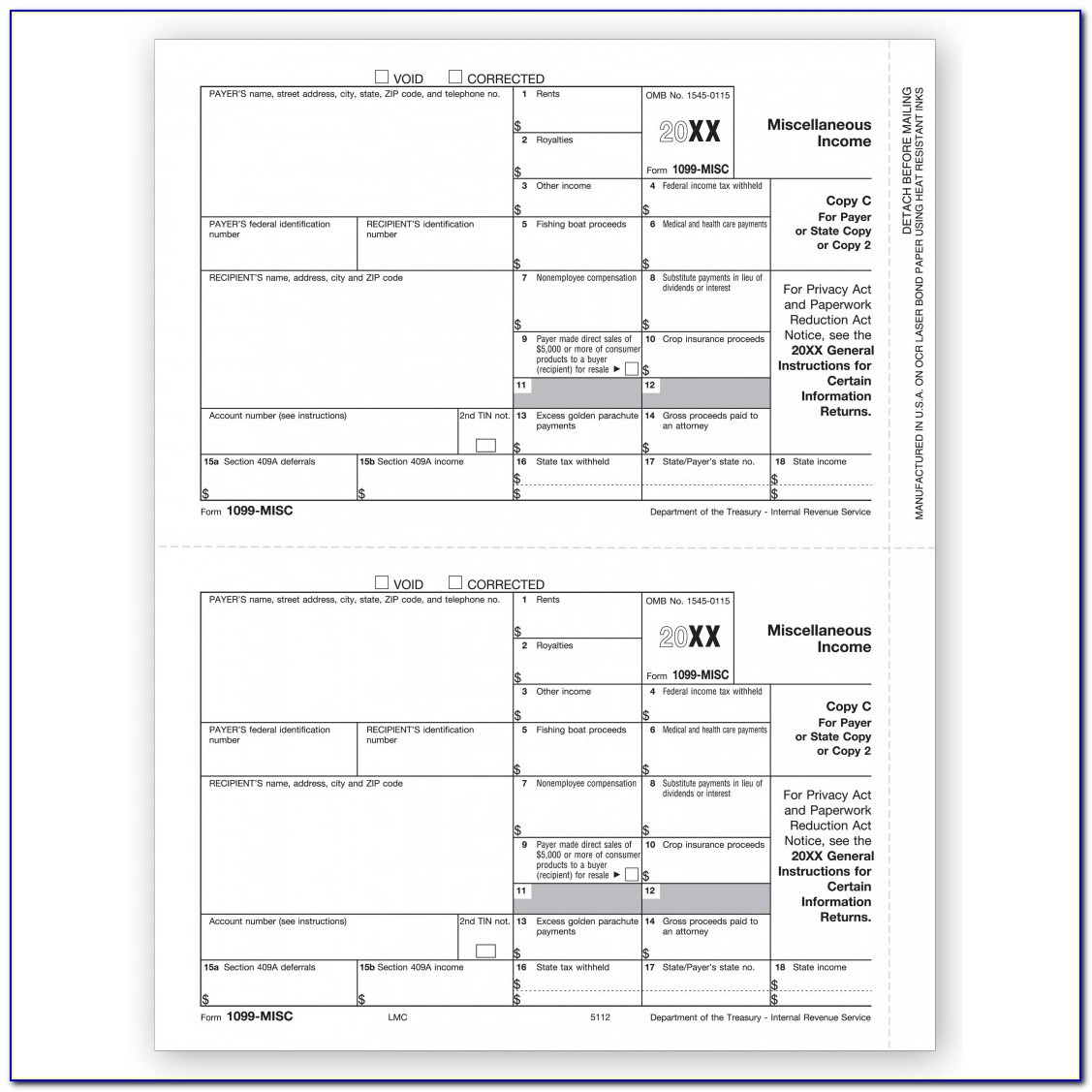

1099 is a series of forms that includes the 1099-B, 1099-S, form 1099-MISC, 1099-NEC, and various other forms. The IRS refers to 1099 as information returns. If you misplace or lose your form 1099, you’ll most likely fail to file your tax return in time, and you might get slapped with a few penalties. These include your form W-2, write-off receipts for taxes, and 1099 for miscellaneous income.

That’s why the last two months leading up to tax day should be spent collecting all the necessary forms for filing your taxes. If you lose important documents, such as the form 1099, April can become even more agonizing to get by. April is the nightmare month for taxpayers the time when you must file your tax returns or incur the wrath of the Internal Revenue Service.

0 kommentar(er)

0 kommentar(er)